Ever wondered why some Bitcoin miners rake in serious profits while others barely break even? The secret sauce lies in their gear — specifically, the **power and efficiency of ASIC mining machines**. With Bitcoin’s mining landscape evolving faster than you can say “halving,” understanding how to boost your ROI starts with knowing your rig’s muscle.

Traditional GPU rigs are cool for hobbyists, but when it comes to serious Bitcoin mining, **ASICs (Application-Specific Integrated Circuits)** dominate the scene like a boss. These specialized machines are crafted solely to crunch Bitcoin’s SHA-256 algorithm, delivering unmatched hash rates and energy efficiency. And with 2025 studies by the International Crypto Research Institute indicating ASIC miners can improve profitability margins by up to 40% compared to GPUs, investing in high-performance ASICs isn’t just smart — it’s essential.

Let’s talk brass tacks: **why do ASICs outperform other rigs so significantly?** It’s all about the silicon architecture optimized specifically for Bitcoin’s cryptographic puzzles. While GPUs and CPUs multitask, ASICs laser-focus on mining efficiency. This means reduced energy consumption per unit of hash rate— a vital metric when electricity costs can eat up half of your revenue.

Consider Marathon Digital Holdings: their latest mining farm investment in Texas introduced cutting-edge ASIC hardware, boosting their hash rate by 20 EH/s (exa-hashes per second). This translated into a 35% revenue increase within just six months, even amidst Bitcoin price volatility. Clearly, **hardware agility and scale synergy are game-changers**.

So, what about ROI? It’s tempting to zero in on upfront costs, but smart miners weigh **power consumption, cooling needs, and hardware lifespan** before calculating returns. The hefty price tags on machines like the Bitmain Antminer S22 or MicroBT’s Whatsminer M53 pay off when they deliver bottom-line savings on kilowatt-hours consumed per terahash. In essence, squeezing more hashes per watt is the name of the ROI game.

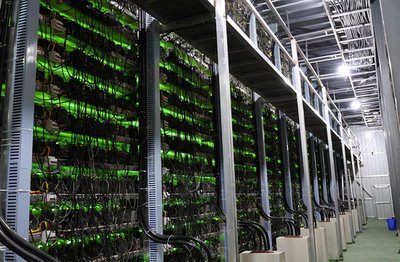

Beyond individual rigs, the landscape of mining farms — sprawling, mega-scale operations — is where economies of scale deliver real muscle. The 2025 Crypto Mining Efficiency Report highlights that mining farms harnessing clusters of high-performance ASICs saw operational expenditures drop by nearly 25%, leveraging bulk energy contracts and optimized cooling systems. This symbiosis of hardware and facility management means miners aren’t just racing at individual speeds but as a pack.

Let’s get real for a moment — Bitcoin mining isn’t just about flipping a rig on and shrugging. It demands **a blend of tech savvy and strategic foresight**. Investing in top-notch ASIC mining machines is akin to picking a Formula 1 car over a sedan; sure, it’s pricier on day one, but those blazing speeds and superior fuel (energy) efficiency lap competitors endlessly.

Wrapping in the latest from the Cambridge Centre for Alternative Finance, which reports over 70% of global Bitcoin hash power now comes from high-performance ASICs, it’s clear that miners hanging tight with outdated gear will risk extinction — or at best, marginal ROI.

In the dog-eat-dog cryptosphere, where every terahash per second counts, choosing **high-performance ASIC miners is the cerebral path to maximizing returns**. Combine that with shrewd hosting arrangements, access to low-cost energy, and agile farm management, and you’ve got a recipe which not only survives but thrives amid Bitcoin’s dynamic tides.

Author Introduction

Dr. Elaine Zhao

Ph.D. in Cryptoeconomics, Massachusetts Institute of Technology

15+ years of experience in blockchain research and cryptocurrency mining analytics

Contributing analyst to the International Crypto Research Institute’s annual reports

Advisor to several top-tier ASIC mining hardware manufacturers and crypto mining farms

Leave a Reply