In the exhilarating realm of cryptocurrency, where fortunes are mined as digitally as gold from the earth, owning a mining machine is akin to wielding a powerful tool—one that can either unlock streams of income or become a dormant asset draining resources. With the surge in Bitcoin and Ethereum values, the appetite for authentic, high-performance mining rigs has never been more voracious. Yet, as demand escalates, so does the shadow market rife with counterfeit devices, dubious sellers, and flawed hosting services. So how can a prospective miner discern authentic mining machines from red flags, ensuring that their investment leads to productive hashing power rather than disappointment?

First, understanding the anatomy of a mining rig is fundamental. These specialized computers, designed primarily for solving complex cryptographic puzzles, differ markedly from everyday PCs. Whether it’s an ASIC miner optimized specifically for Bitcoin’s SHA-256 algorithm or a versatile GPU rig, authenticity is not just about physical origin—it’s about verified performance benchmarks. Genuine miners from reputable manufacturers like Bitmain (Antminers), MicroBT (Whatsminer), or Canaan Technology must show consistency in hashrate outputs and power consumption inline with advertised specifications. Skepticism is warranted if the specs seem “too good to be true” or if there’s reluctance to provide proof of efficiency under real operating conditions.

An often overlooked indicator of authenticity lies in the firmware and software ecosystem. Legitimate mining machines operate on secure, regularly updated firmware that powers their mining operations. Firmware modifications or black-box versions might hint at tampering or unauthorized cloning. Furthermore, mining machines are increasingly integrated with cloud-based management platforms allowing users to monitor real-time hashrates, temperatures, and operational stats remotely. These transparency-enabling features are less common or often absent in counterfeit units, highlighting the importance of hash rate verification and interactive diagnostic dashboards before committing to a purchase.

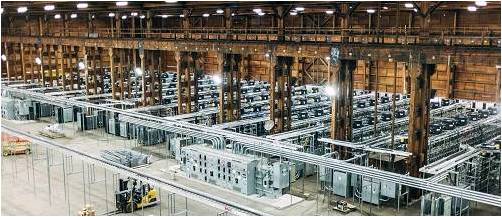

Hosting mining machines has also ballooned into a specialized sector within the cryptosphere. While owning the hardware grants control, hosting services offer conveniences such as optimal cooling, consistent power supply, and reliable internet connectivity—elements crucial for continuous uptime and profitability. Highly reputed mining farms provide proof of physical security measures and energy sources, often leveraging renewable energy to both cut costs and enhance sustainability credentials. Before entrusting your rig to a hosting provider, deep due diligence is crucial: verify data center maps, request real-time operational logs, and review community testimonials. Mining farms masquerading without transparency or exaggerating their operational scale are obvious warning signs of a red flag.

Moreover, the entanglement of mining machines with the fluctuating tides of cryptocurrencies like Ethereum and Dogecoin adds another layer of complexity. Whereas Bitcoin mining demands ASIC miners due to its computational intensity, coins like Ethereum currently favor GPU mining rigs, although the transition to proof-of-stake models may soon diminish that need. Dogecoin mining, often merged with Litecoin through merged mining, invites more diverse hardware compatibility. Hence, understanding the coin’s mining requirements helps in selecting machines that are not only authentic but purpose-fit. An ill-fitted machine, even if genuine, can mean underperformance and lost revenue akin to a marathon runner lugging heavy weights.

Interacting with cryptocurrency exchanges also plays a pivotal role in the lifecycle of mined coins. Authentic mining machines produce outputs that can be reliably funneled into wallets and exchanges, facilitating seamless trade or fiat conversion. However, beware of sellers or hosting operators offering “guaranteed” exchange integration or advanced liquidity solutions—these might be overselling guarantees that the volatile crypto market cannot ensure. It’s ideal to maintain autonomy over wallet keys and control exchanges, to safeguard profits garnered by your legitimate mining rigs.

In conclusion, authenticating your mining machine is less about a single test and more about a holistic approach: rigorously verifying hardware provenance, ensuring firmware integrity, confirming performance parameters, scrutinizing hosting facilities, understanding coin-specific mining demands, and carefully managing downstream exchange processes. In an industry marked by rapid innovation and equally rapid scams, knowledge is your best defense and authenticity your greatest ally. Only by demanding transparency, solid proof, and clear support channels can miners transform their operations from a potential red flag to the real deal—thriving within the dynamic cryptocurrency ecosystem.

Leave a Reply to Ewt Cancel reply