Bitcoin mining stands as the backbone of the cryptocurrency world, a digital gold rush where powerful machines crunch complex algorithms to validate transactions and mint new coins. Yet, beneath this lucrative facade lies a labyrinth of risks that can turn fortunes into dust. From volatile market swings to the relentless hum of overheating hardware, miners must navigate a treacherous path to success. In this article, we delve into the intricacies of Bitcoin mining risks and arm you with expert recommendations to emerge victorious in this high-stakes game.

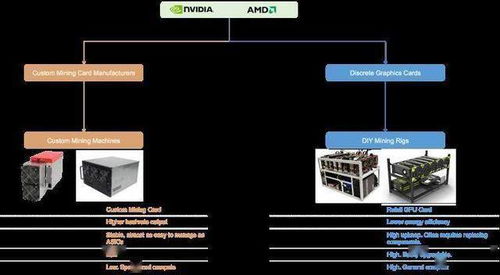

At its core, Bitcoin mining involves solving intricate mathematical puzzles using specialized hardware known as mining rigs. These beasts of computation, often powered by Application-Specific Integrated Circuits (ASICs), consume enormous amounts of electricity, turning mining into an energy-intensive endeavor. But what happens when electricity costs skyrocket or power grids falter? The financial strain can be immense, especially for those operating independently. Diversifying into other cryptocurrencies like Ethereum, which employs a proof-of-stake model post its Merge upgrade, might offer a less power-hungry alternative. Meanwhile, Dogecoin mining, with its lighter Proof-of-Work requirements, appeals to hobbyists but still carries the inherent volatility of meme-driven markets. Experts recommend assessing energy efficiency ratings before purchasing a mining machine, ensuring it aligns with your hosting setup to mitigate these operational hazards.

One of the most unpredictable aspects of mining is market volatility. Bitcoin’s price can swing wildly, influenced by global events, regulatory news, or even social media buzz. Imagine investing in top-tier mining machines only to watch Bitcoin plummet due to a sudden exchange hack or government crackdown. This is where diversification becomes key—perhaps allocating resources to Ethereum staking or Dogecoin for quicker returns. Mining farms, vast warehouses filled with synchronized rigs, amplify these risks on a larger scale. A single regulatory shift could render an entire operation unprofitable. To counter this, experts suggest using reputable exchanges for selling mined coins and employing hedging strategies, such as futures contracts, to stabilize income.

Hardware reliability poses another formidable challenge. Mining rigs, while robust, are not immune to failures. Overheating, dust accumulation, or component wear can halt operations abruptly, leading to lost revenue during downtime. This is where professional hosting services shine, offering climate-controlled environments and 24/7 monitoring. For instance, partnering with a company that specializes in mining machine hosting can reduce these risks by providing redundant power supplies and expert maintenance. Miners venturing into Ethereum or Dogecoin might find that their rigs need upgrades for optimal performance, making regular assessments crucial. Experts advise investing in quality miners from trusted sellers to ensure longevity and efficiency in your setup.

The competitive landscape of mining adds layers of complexity. As more players enter the field, the difficulty of Bitcoin’s blockchain increases, demanding ever-more powerful hardware. This arms race can erode profits, particularly for solo miners lacking the scale of dedicated mining farms. Ethereum’s shift to proof-of-stake has already altered this dynamic, potentially making it a safer bet for newcomers. Dogecoin, with its inflationary model, might seem less competitive but still requires strategic planning. To thrive, experts recommend joining mining pools, where resources are pooled for better chances of rewards, and exploring hosting options that scale with your needs. This collaborative approach can transform individual risks into shared opportunities.

Security threats loom large in the crypto realm. From phishing attacks on exchanges to malware targeting mining software, the digital wild west is fraught with peril. A single breach could compromise your wallet or hijack your rig for illicit mining. This underscores the importance of robust cybersecurity measures, such as multi-factor authentication and encrypted connections. For those hosting machines remotely, ensuring that the facility employs top-tier security protocols is non-negotiable. Experts emphasize educating yourself on these risks, perhaps by attending webinars or consulting with professionals, to safeguard your investments in Bitcoin, Ethereum, or even Dogecoin.

Finally, regulatory uncertainties can upend the mining industry overnight. Governments worldwide are grappling with how to regulate cryptocurrencies, with some imposing bans or heavy taxes on mining activities. This could affect not just Bitcoin but also altcoins like Ethereum and Dogecoin, potentially disrupting exchanges and hosting services. To navigate this, experts advise staying informed through reliable sources and considering jurisdictions with favorable crypto policies for your mining operations. By adopting a proactive stance—regularly updating your strategies and diversifying across assets—you can turn potential pitfalls into pathways for sustained success in the ever-evolving world of cryptocurrency mining.

In conclusion, while Bitcoin mining brims with potential rewards, it’s a venture riddled with risks that demand careful navigation. By heeding expert recommendations—ranging from hardware selection and energy management to market diversification and security protocols—you can enhance your chances of long-term success. Whether you’re drawn to the stability of Ethereum, the fun of Dogecoin, or the pioneering spirit of Bitcoin, remember that informed decisions and strategic partnerships, like those offered by reliable mining machine sellers and hosts, are your greatest allies in this dynamic digital frontier.

Leave a Reply